Financing Solutions for Contractors & Builders

Secure and quick loans for your construction projects and equipment purchases.

We work with

Contractors

Builders

Sub Contractors

Best Loan Products

Get easy access to different kinds of loan products for your business needs.

Apply for CE Loan

Interest Rate

9-12%

Approval in 24-48 hours

Apply for Business Loan

Interest Rate

10-15%

Approval in 24-48 hours

Apply for LOC

Interest Rate

9-15%

Approval in 24-48 hours

Best Mock Tests

FREE

5 Mock Tests

200+ Mocks

Attempted

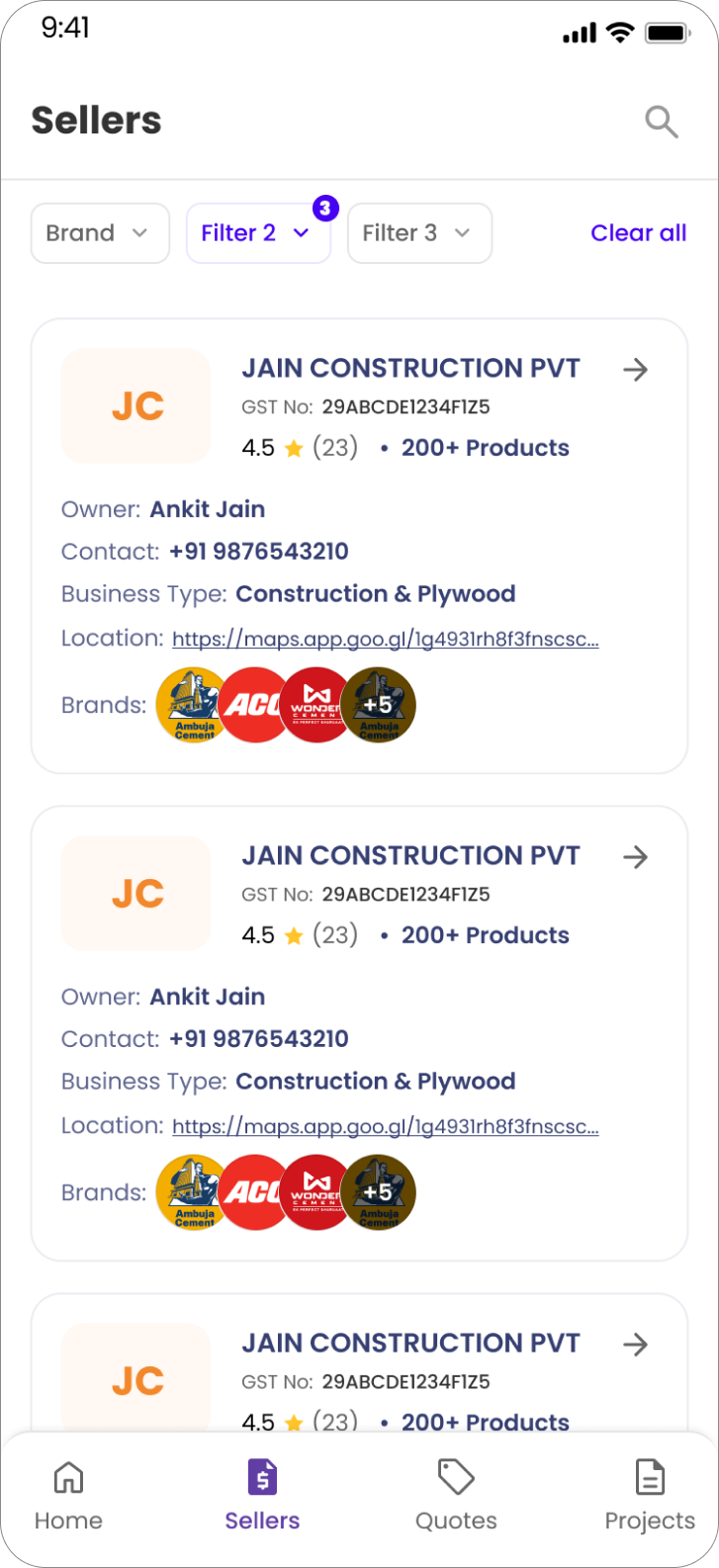

Robust Network of Dealerships across India

Get Loan on any Equipment

Approved and disbursed within 24 - 48 hours

Factors for line of credit approval

CIBIL Score

Tax Fillings

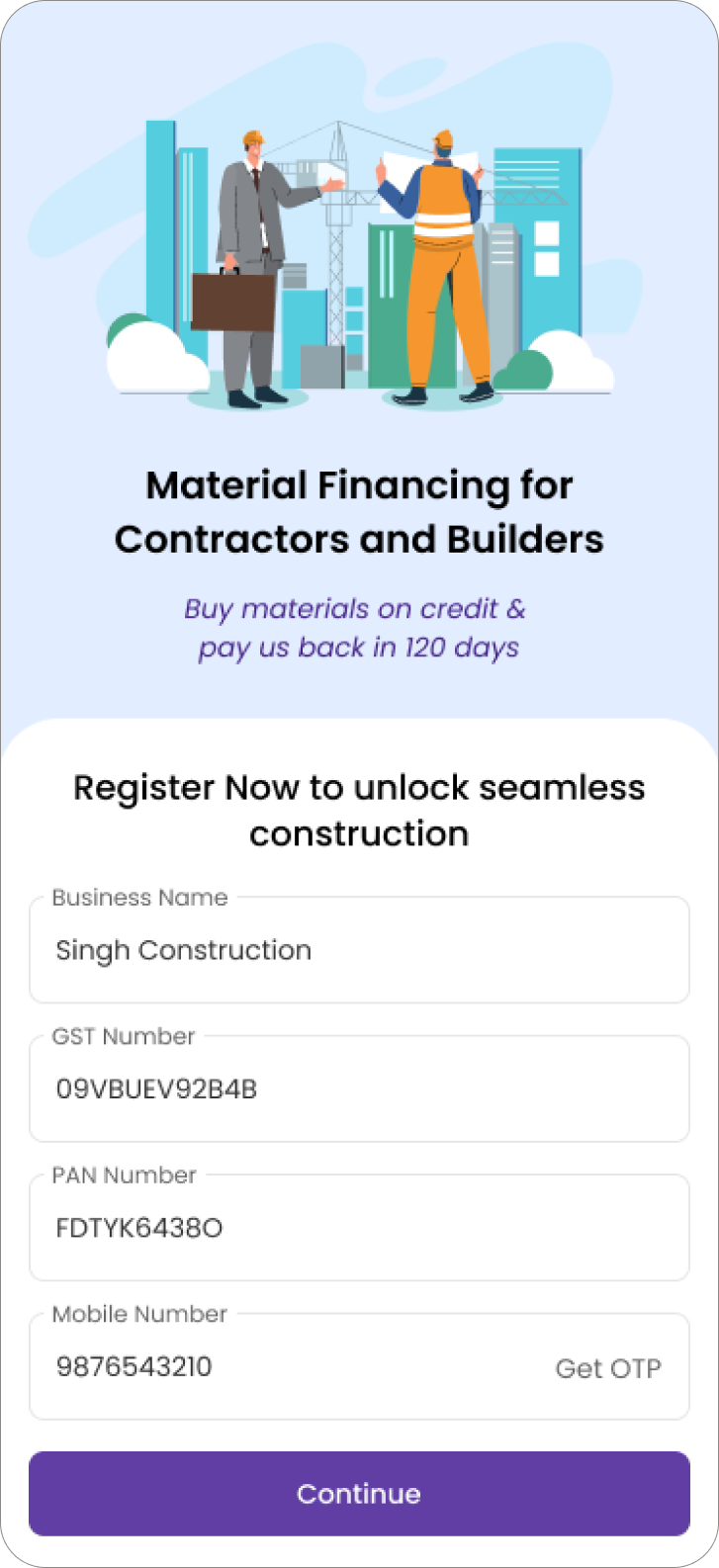

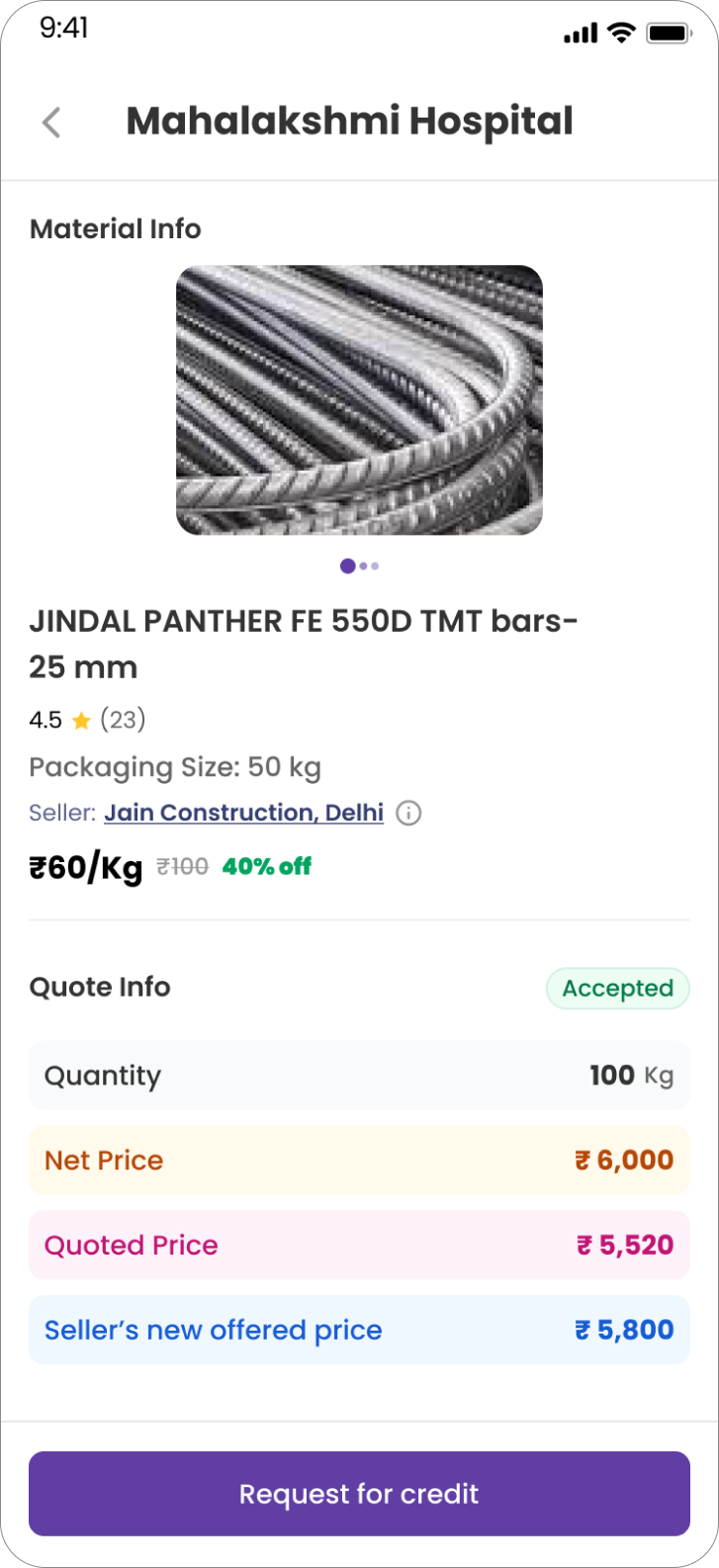

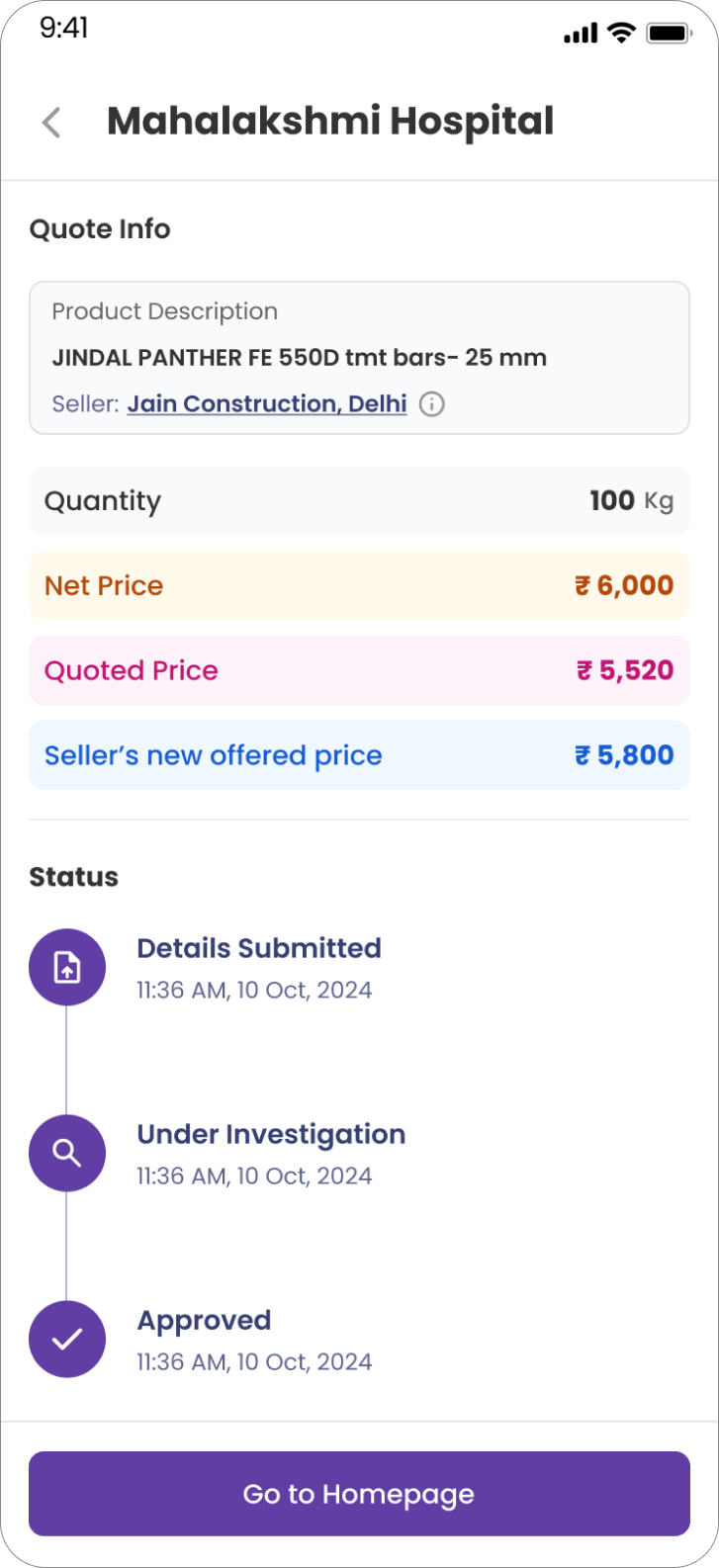

Apply for 120-Day Material Financing

We make it easy to buy materials upfront. Get the financial support you need for any project, current or in pipeline

Get credit upto 32% of the project value

Your credit limit is calculated using advanced algorithms that analyze your CIBIL score and tax filing volume.

Collateral Free Credit

No collateral is required, but E-NACH setup is mandatory for the approved amount.

Repayment period of upto 120 days

Enjoy a 120-day repayment period with the first 21 days interest-free. Interest accrues daily after that, and you can repay anytime within 120 days.

We work with any supplier in the country

Talk to us now !

Bid on bigger projects knowing you have the support to take them on

Get instant cash buying power

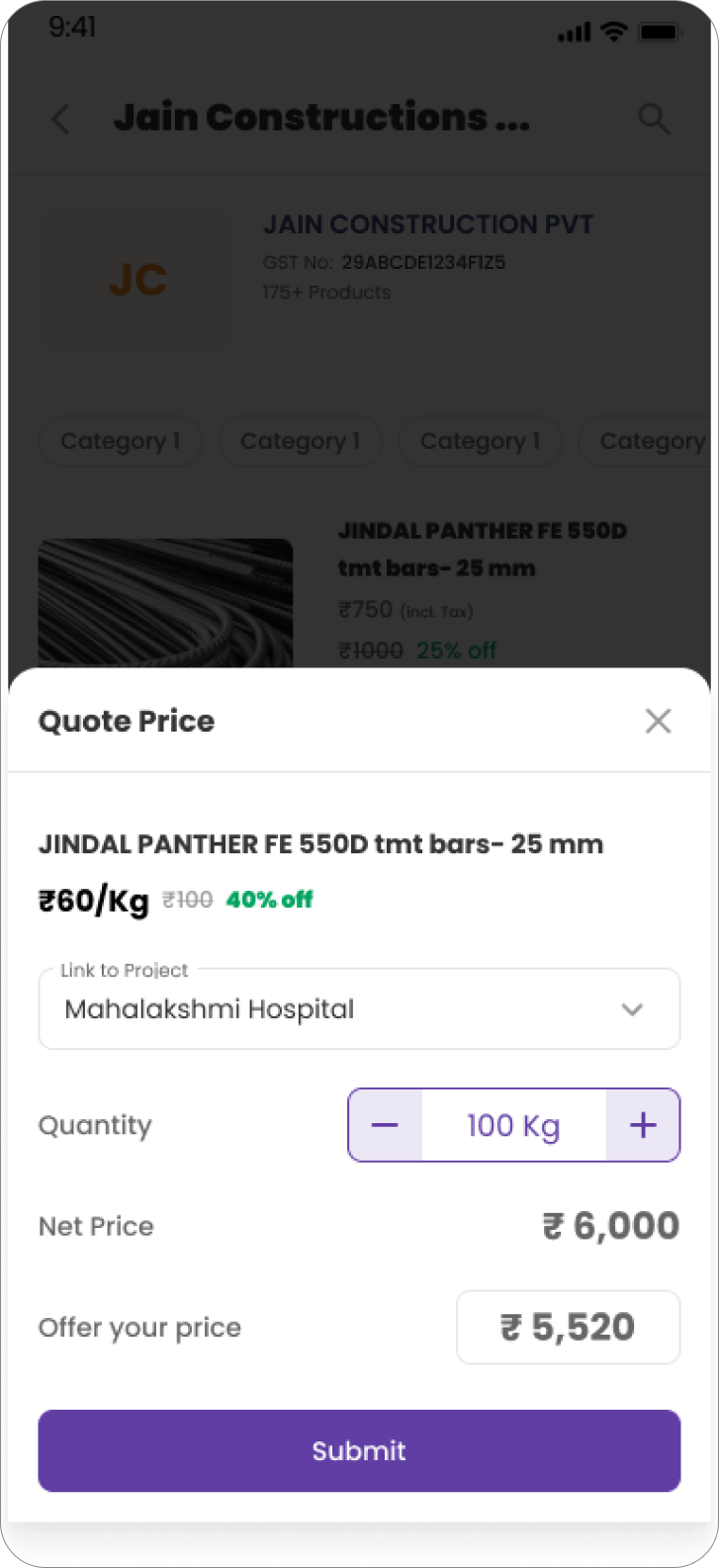

Gain leverage to negotiate with suppliers.

Control your cash flow

Receive materials upfront, and pay for them over time.

Plan with confidence

Bid more jobs knowing your future financial position.

Unlock more capital

Your credit limits flex with the needs of your business.

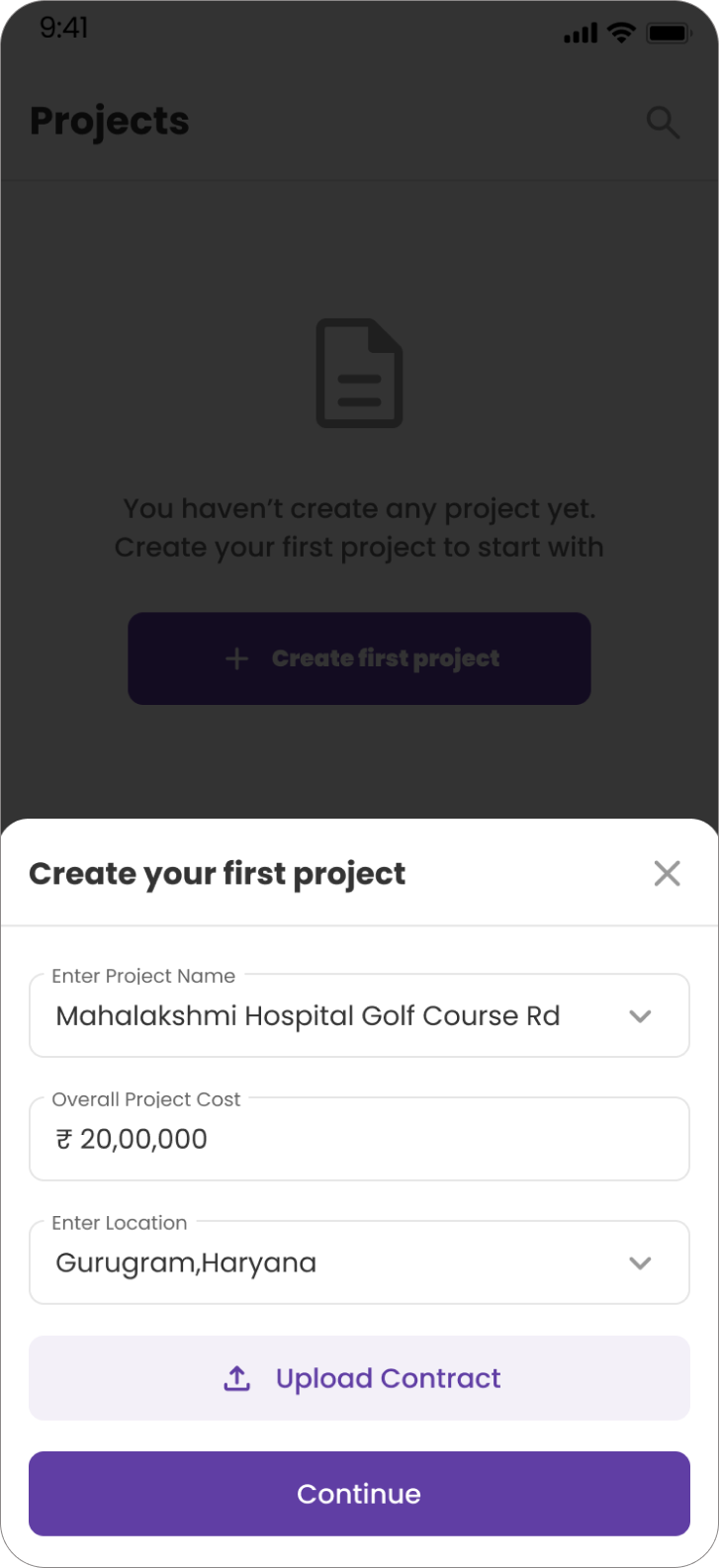

Get Instant Project based line of credit

Frequently Asked Questions

Q1. What is 120-Day material financing?

Its a kind of working capital loan which allows you to purchase material from a supplier upfront on credit and you pay back when you get paid from your client or in 120 days.

Q2. What are the documents required to avail material financing?

We would need your tax fillings and audited balance sheet for the last 3 years along with your company details.

Q3. How much line of credit will we get for a particular project?

The available line of credit is calculated based on your overall profile and the total cost of the project you are working on. It is usually upto 32% of the project value. For example: If you have taken up a commercial project worth 1Cr, your business can get credit line of upto 32 Lakhs.

Q4. Will the installments get automatically deducted from my bank account or do I need to submit PDCs?

During the onbooarding process our app asks you setup E-Nach as a mandatory step which will MasonPe to automatically deduct due amounts from your bank account till a certain limit. There is no need to submit PDCs.